GameStop is a company synonymous with ups and downs. Although at one point the destination for video game aficionados, GameStop has fallen on harder times. In a digital era full of e-commerce and web-based options like Steam and Amazon, the brick-and-mortar retailer faces similar challenges to other former giants like Blockbuster.

However, a fall of fortune isn’t the only thing the company is known for. In a recent interview, GameStop co-founder Gary Kusin spoke of, amongst other topics, the company’s approach to the great GameStop Short Squeeze of 2021.

GameStop’s Evolution and Market Challenges

After beginning as Babbage’s before being bought out by Barnes & Noble for a time, GameStop finally became an independent company in 2004. This allowed them to focus solely on the video game market.

It was a major player in the video game industry, as they offered a wide variety of games, consoles, and accessories, often being the only option for brick-and-mortar purchases. Midnight releases were a big deal, fostering a sense of community and excitement.

However, the rise of digital marketplaces and online retailers placed pressure, as their more competitive prices, broader selections, and convenience caused them to bleed away many customers.

In time, GameStop’s focus on used games and pre-orders became less appealing to many customers. with infamously low trade-in values for used games also didn’t help matters.

In 2021, GameStop’s fall in stature brought the attention of Stock Market speculators. Several hedge funds, including Melvin Capital, heavily shorted the stock (GME), betting its price would decline. Shorting involves borrowing shares, selling them, and hoping to repurchase them later at a lower price to return them for a profit.

As Gary Kusin recounts:

When all that happened, my co-founder and I made a conscious decision that we would not talk to the press. We knew exactly what was going on. GameStop was the first company to develop such a deep relationship with its customers that has withstood the test of time. Our store was so embedded in the gamer’s DNA to the point that many gamers still mark stages of their life by what game was releasing.

A group of individual investors, particularly those active on the Reddit forum r/wallstreetbets which is renowned for its lively conversations and daring investment tactics, noticed the high short interest in GME. They believed the company was undervalued and had the potential for a turnaround.

Though Kusin tends to paint the picture as GameStop’s loyal customers coming to the dogged company’s defense, even going so far as comparing GameStop customers to Taylor Swift’s “Swifties” – in reality most of the players here simply saw an opportunity to make some dough as well as stick it to “the man”.

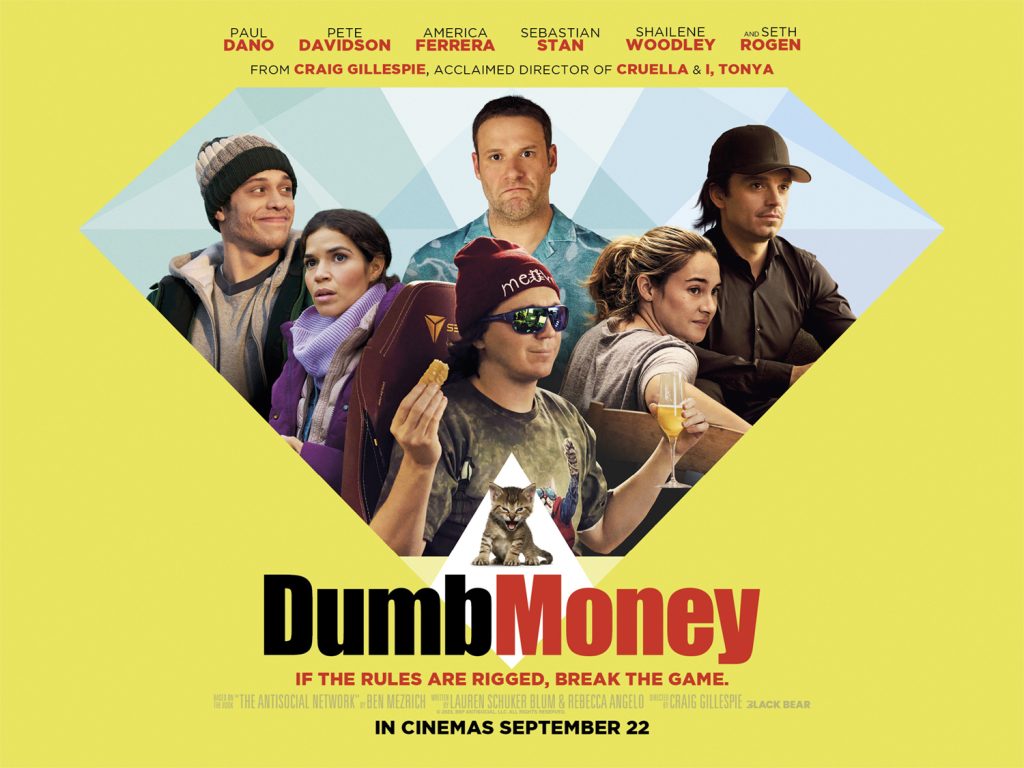

The Dumb Money Fall Out

The GME stock price soared from around $17 per share to over $500 within a few weeks due to a massive influx of buying. The price increase caused significant losses for short sellers, who scrambled to buy back shares to cover their positions, further accelerating the price increase. The volatile situation led to some online brokerages, such as Robinhood, restricting trading on GME.

As Kusin states:

The hedge funds saw the writing on the wall when it came to digital purchases taking the place of physical ones and make the idea of GameStop obsolete. However, their algorithms did not account for was the power of the relationship between GameStop and its customers, to the point where those customers were happy to go to battle against the big money.

He continued:

GameStop was the first company to develop such a deep relationship with its customers that has withstood the test of time. When you then factor in a huge communication tool like Reddit, which was able to unify all of the birds of different feathers, it became unstoppable. It is essentially like someone telling a mom and dad that their baby is ugly; you just can’t do that and that’s what Wall Street was doing.

While Kusin’s statements in our exclusive GameStop interview do bear some truth, the company does have a loyal customer base – particularly among older gamers, some claims might be a bit exaggerated. The perception of GameStop amongst gamers is mixed. Nostalgia coexists with frustration over pricing and selection.

However, the company’s recent focus on e-commerce can win back support depending on its effectiveness. Although Kusin’s take is a bit exaggerated and tinted with rose-colored glasses, there’s no question the Short Squeeze of 2021 had a big effect on GameStop’s perception of itself as a company.

If GameStop can adapt to changing consumer habits and effectively compete in the digital space they may create a path forward for future success.